Standard Bank Investor Relations : Annual Reports

Content

The second is around creating a new mass affluent proposition that joins up across banking, protection and investments and insurance products. Our first stand-alone climate report provides detail of progress on our climate strategy and our reporting against the recommendations of the Task Force on Climate-related Financial Disclosures. Before acting on any information in this material, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only correct as of the stated date of their issue.

What is difference between income statement and bank statement?

The balance sheet and income statement represent important information regarding the financial performance and health of a business. An income statement assesses the profit or loss of a business over a period of time, whereas a balance sheet shows the financial position of the business at a specific point in time.

The Annual Report includes consolidated financial statement information and narratives of various program achievements in a condensed format that can be widely distributed. And the final one is focusing and growing around our UK linked corporate and institutional businesses with a very focused offering around cash, debt and risk management services. With a market capitalisations of approximately R271billion as at 30 June 2022, Standard Bank offers a range of banking and related financial services across sub-Saharan Africa. On this page you will find the annual reports of Credit Suisse AG and the Credit Suisse AG , as well as our Sustainability Report available for download. OurCOVID-19 financial reporting resource centreincludes articles, blogs and podcasts to help you better understand the accounting and disclosure implications of the COVID-19 pandemic for your company. The specific reporting requirements depend upon the size of the institution, the nature of its activities, and whether it has any foreign offices. A bank is a financial institution licensed to receive deposits and provide other services such as mortgage loans and individual retirement accounts.

ASSET MANAGEMENT

The FDIC provides a wealth of resources for consumers, bankers, analysts, and other stakeholders. Browse our collection of financial education materials, data tools, documentation of laws and regulations, information on important initiatives, and more.

The Bank’s annual report is combined with the annual report of the Group and includes the consolidated and parent company financial statements of the Bank. Consolidated financial statements, Information on the company, Operating and financial review, Treasury and risk management, Corporate governance and Compensation. In addition, it contains the cornerstones of our strategy and the key figures for the financial year 2017.

Shareholders Info

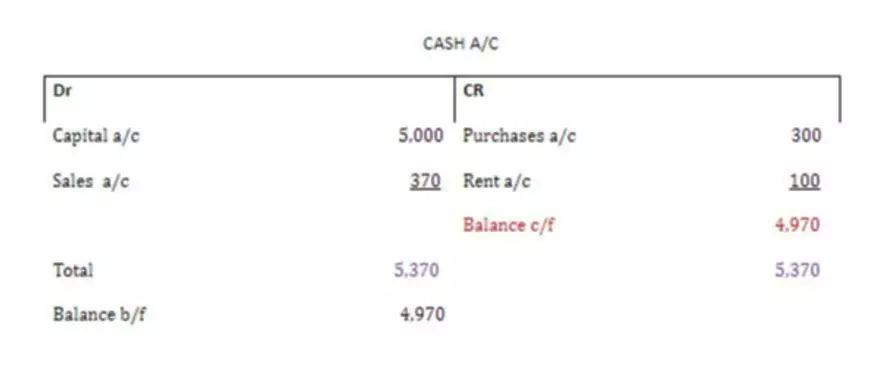

Institutions identified as G-SIIs are required to disclose, annually, the values of the indicators used for determining the G-SII status and capital requirements. A summary of our risk profile, its interaction with the Group’s risk appetite, bank financial statements and risk management. The annual percentage yield is the effective rate of return on an investment for one year taking compounding interest into account. Cash is cash held on deposit, and sometimes banks hold cash for other banks.

BofA has roughly $157 billion in cash which is an important focus for investors that are hoping for the bank to increase its dividend or share buybacks. Net interest income totaled $44.6 billion for 2017 and is the income earned once expenses have been taken out of interest income. Again, net interest income is mostly comprised of the spread between interest earned from loans and the interest paid out to depositors.

FDIC Call Report Analysts

As a result, as interest rates rise, banks tend to earn more interest income, but when rates fall, banks are at risk since their interest income declines. Apple’s income statement will have a revenue line at the top titled net sales or revenue. For a bank, revenue is the total of the net-interest income and non-interest income. To make matters confusing, sometimes analysts quote total interest income instead of net interest income when calculating revenue for banks, which inflates the revenue number since expenses haven’t been taken out of total interest income. The primary business of a bank is managing the spread between deposits that it pays consumers and the rate it receives from their loans. In other words, when the interest that a bank earns from loans is greater than the interest it pays on deposits, it generates income from theinterest rate spread. The size of this spread is a major determinant of the profit generated by a bank.

We help developing countries achieve sustainable growth by financing investment, mobilizing capital in international financial markets, and providing advisory services to businesses and governments. Our illustrative disclosures for banks are based on a fictitious banking group involved in a range of general banking activities, which is not a first-time adopter of IFRS Standards. The 2021 edition (PDF 2.9 MB) reflects standards in issue at 30 November 2021 that are required to be applied by an entity with an annual period beginning on 1 January 2021. The FDIC is proud to be a pre-eminent source of U.S. banking industry research, including quarterly banking profiles, working papers, and state banking performance data.

Total interest earned was $57.5 billion for the bank from their loans and all investments and cash positions. Hear from Charlie Nunn, Group Chief Executive https://www.bookstime.com/ and Carla Antunes da Silva, Group Strategy, Corporate Development and Investor Relations Director, on our ambitions and the next chapter of our strategy.